✍️ The prologue

My name is Aris Xenofontos and I am an investor at Seaya Ventures. This is the deepdive version of the Artificial Investor that comments on one of the top AI developments of the last few days.

This Week’s Story: OpenAI goes on a spending spree - acquires coding solution for $3bn and AI hardware developer for $6.5bn

Last week, OpenAI announced its 6.5-billion-dollar acquisition of io, an AI hardware development company co-founded by iPhone’s designer, Jony Ive, in 2024. This announcement came a few days after Bloomberg reported that OpenAI agreed to acquire the coding application, Windsurf, for 3 billion dollars. Windsurf was launched in 2023 and reached 100 million dollars of annualised revenue by May 2025.

What is Windsurf and what are the deal economics? Is Windsurf worth 3 billion dollars? What does this acquisition mean for GPT wrapper founders and investors? What does the io acquisition mean about OpenAI’s strategy?

Let’s dive in.

Introduction

⛵ What is Windsurf?

Windsurf is an AI-powered coding application designed to simplify the software development process for users of all technical levels. It functions as a smart assistant that can understand your goals, suggest code and even execute tasks like setting up projects or fixing bugs. By integrating features such as real-time previews and intelligent code suggestions, Windsurf aims to keep users in a productive "flow state," minimising distractions and streamlining the development workflow. This makes it an accessible tool for both seasoned developers and those new to coding.

Windsurf was founded as an AI infrastructure-as-a-service company called Exafunction in 2021 by MIT graduates Varun Mohan (previously Tech Lead at Nuro) and Douglas Chen (previously Software Engineer at Facebook). The Californian company raised a 25 million-dollar Series A in 2022, was renamed to Codeium (the product has been branded Windsurf) and pivoted to an AI coding solution in 2023. To date, they have raised a total of 243 million dollars by US investors, such as Founders Fund, General Catalyst and Kleiner Perkins.

💵 What are the OpenAI/Windsurf deal economics?

OpenAI agreed to acquire Windsurf for 3 billion dollars, which was the alleged valuation of the latest investment made by Kleiner Perkins in the company in February 2025. Windsurf was reportedly at 40 million dollars of annualised revenue (ARR) back then, but grew extremely fast and reached 100 million dollars of ARR by May 2025. So, although many online articles talked about an acquisition price of 75x ARR, in reality it is being acquired for 30x ARR.

The acquisition is agreed as a share swap, which means that OpenAI is not spending any of its precious cash. Instead, Windsurf’s investors, founders and employees will receive OpenAI shares. As OpenAI’s current valuation is 300 billion dollars, this means that OpenAI will issue 1% of shares to distribute to Windsurf’s shareholders.

Allegedly, OpenAI had previously held talks with about 20 companies in the AI coding space and had approached Anysphere, the creator of the AI-powered code editor Cursor, in both 2024 and early 2025. Despite OpenAI's interest, Anysphere declined the acquisition offers, opting to remain independent and pursue further funding rounds. In May 2025, Anysphere announced a 900-million-dollar funding round at a valuation of 9 billion dollars.

🐻 The bear case - why Windsurf is not worth 3 billion dollars

💰 Expensive deal

The 30x ARR acquisition price is significantly higher than the revenue multiple of the top 10 AI companies. If Meta trades at 9x, Tesla at 11x and the AI darling, Nvidia, at 24x, how can Windsurf be worth 30x revenues?

🏪 The business model is broken

We did our own analysis of Windsurf’s financials based on leaked numbers (as of February 2025)

Annualised revenue of 40 million dollars

800,000 monthly active users on the platform (not all of them paying but all of them interacting with AI, generating tokens and increasing AI infrastructure costs)

An average user consumes 2 million tokens per day

Taking into account a typical cost per token and the number of users, that takes us to an annual cost of tokens of 70 million dollars. So, on the annualised revenue of 40 million dollars, we would have a gross loss of -30 million dollars. This negative gross margin indicates an issue with the business model, as it’s about how much the company is losing purely to deliver its product (even if it had zero employees).

Let’s sanity-check this number. What would that mean for Windsurf’s total annual cash burn and how would it compare with its previous funding round?

Windsurf had 166 employees in February 2025, with the majority based in the Bay Area and Texas. Assuming an average cost per employee of 150,000 thousand dollars, plus some non-people costs, we get to a total annual operating loss of about -66 million dollars. The last funding round prior to that point was 150 million dollars (August 2024). With an annualised cash burn of 66 million dollars that funding round would give the company a cash runway of 2.3 years, which is in line with what we see in the market - so the numbers seem to stack up.

Hence, there is a business model issue. Windsurf would either have to charge users more or limit the number of tokens consumed by each user or eliminate its free plan or just keep burning money until infrastructure costs decline further.

🌯 It is just a wrapper around OpenAI’s own models

Back in 2023, after the release of OpenAI’s ChatGPT, we had the emergence of thousands of applications with very simple functionality. They had a basic Web user interface that was linked with a simple API connection to an OpenAI model. The functionality was limited to i) a customised set of instructions that was added at the beginning of the prompt of the end user, ii) system instructions to set the tone of the chatbot, and iii) a couple of documents attached to every chat conversation to provide further context to the chatbot. These companies were labelled as GPT Wrappers (due to being user interfaces wrapped around a GPT model). While user and revenue growth for many of these applications was exponential, there was a lot of criticism around their defensibility due to the ease of replicability and high dependence on OpenAI. In November 2023, the critics were confirmed. OpenAI launched GPT Builder, an application that allowed users to create their own GPT Wrapper, and killed a large part of the market overnight.

There has been similar criticism on OpenAI’s acquisition with claims that “Windsurf is just a wrapper around OpenAI’s own models”.

⛓️ It is fragile due to its dependence on the Microsoft platform

Another big criticism from the developer community is how Windsurf (and other competitors) depends on Microsoft. This is something not commonly known and we need to get a bit technical to explain this. A special thanks to Rob Smith, who pointed out that risk.

Windsurf is an IDE, which stands for Integrated Development Environment. Its base code comes from an open-source IDE application called Visual Studio. That open-source code was developed by Microsoft and is available to everyone under the MIT licence for free. Windsurf and others like Cursor have expanded this code to customise it in order to be able to launch AI features in it. This is called a fork. Until here, all fine.

However, since the start Microsoft has restricted the use of any extensions developed by Micrsoft and banned them from Visual Studio forks. There are some important extensions that Microsoft has developed, such as one that enables the development in C++, one that allows remote development through a secure connection (called SSH), and one that allows Windows users to build in Linux (called WSL). These are three extensions that are very popular with professional developers and for many of them are indispensable.

These extensions were available in Windsurf and Cursor when they launched, but as usage increased and competition heated up for Microsoft’s similar AI product (Github Copilot), the BigTech company got more serious about enforcing its original restrictions.

While the Windsurf developer community is working on developing extensions that replace the ones developed by Microsoft, and are banned from the platform, it remains to be seen how many users Winsurf may lose until this happens.

👽 Losing independence may alienate users

Another risk with this acquisition is the fact that Windsurf will be losing its independence. At the moment, Windsurf links to many different models developed by various frontier labs such as OpenAI, Anthropic, etc., as well as open-source models, effectively allowing users to pick the right model for the task. This is part of its advantages as a product.

Presumably, after the acquisition, OpenAI will likely force Windsurf users to only use OpenAI's models, which could hinder the product's effectiveness.

🐂 The bull case - why Windsurf is worth 3 billion dollars

🐘 Huge market opportunity

The expectations for growth, which are typically linked to the valuation of a company, are very high. We saw earlier the historical growth rate and how it has accelerated. But it's not just about how much the company is growing now; rather, it's about how big it can get.

The development market is huge. At the moment, there are 30 million developers and expected to grow to 45 million by 2030. Taking Windsurf's price of 15 dollars per month and a market share of 20% for a top 2 player, we get to a potential 2 billion dollar revenue opportunity. Furthermore, the development market is expanding with tools like this (as well as prototyping tools like Replit, Bolt and V0) as they reduce the entry barriers for non-technical users. The high expectations for AI userbase growth are demonstrated in recent valuations of private funding rounds of AI companies.

📃 Data network effects

Data is king in the era of AI, as we've said many times, and there are three types of valuable data here.

First of all, the actual coding data that helps improve the actual coding AI models. Coding models have been trained on code that sits in open-source repositories (see Github) and debugging discussions in development forums (see Stack Overflow). This content is of varied quality which in turn impacts AI model quality. This is demonstrated by various studies that show that AI is good at getting poor performers to reach an average level, but not as good at getting top performers even better.

The second piece of data is Windsurf’s usage data. 800,000 monthly active users spend daily 2m tokens interacting with the product. Every prompt, every time a user declines or accepts an AI model's suggestion, every time they delete something that has been auto-completed by the AI model, Windsurf is collecting valuable data that helps the product improve. This is what people often call the knowledge graph.

The third piece of valuable data is related to human-AI interaction. This is the very first time we have a use case of AI agents deployed at scale in a market that clearly has a very strong product/market fit. So this is bigger than coding; it’s about how humans interact with AI agents, and it can have a big impact on the future development of other agentic products for OpenAI (Codex, Agent SDK, Responses API, etc).

The value of data is demonstrated by the evolution of the AI coding application pricing models. They started off as free. Then they started charging by prompt/tokens in order to cover the infrastructure costs, and reached the point of premium subscriptions at 200 dollars per month. Then, after realising the value of their data, they went down to a fixed price of 15-20 dollars per month (the fixed aspect of the model is key as it eliminates usage friction), to then eventually go back to free (OpenAi Codex and Google Jules recently).

👥 Large user community

Windsurf boasts 800,000 active developers on a monthly basis (as of February 2025). At that time, there were 200,000 paying users (based on its total revenue and subscription price). This translates to a 25% conversion rate, which is very high compared to the freemium product benchmarks we have and indicates that users love the product and are likely to convert once they try it.

Given that annualised revenue has since grown to 100 million dollars, assuming the same conversion rate, the monthly active users should be about 2 million by now. This is a huge community of users that use a product every day and see it as an important part of their work. This presents a lot of cross-selling opportunities in the coming years to monetise the userbase even further.

💻 UX and product execution

There are many UX-related value drivers that we believe in, which are typically not very popular with the venture capitalists due to being intangible.

It's becoming increasingly easy to build software. Many software engineers that previously could only develop small functionalities can now build an entire piece of software. However, a collection of software functionalities is not the same thing as a product. A product has a great user experience, solves end-to-end problems, gets embedded into someone’s workflow in a seamless way, and people love using it. Despite the fact that it's become easier and faster to copy someone else's software using AI tools, without product leadership then you will always be a year behind the one who does.

Product excellence in a software engineer solution is not that easy. Developers are very demanding users and rely on such products for their daily job, every single day.

Windsurf stands out for a couple of product features, such as a better understanding of the entire codebase and superior user experience in hybrid mode (human + AI) for advanced developers.

♟️ OpenAI’s strategic benefits

Build vs. buy

It's a classic build vs buy dilemma playing out in real life. If OpenAI wanted to develop its own Windsurf, it would definitely take a significant amount of money, but it's not about the cost. It's the diversion of software engineers away from other high-stake projects and the time to market in a rapidly-developing AI market where speed matters. Windsurf's product and user experience has been refined over millions of iterations with users, and incorporating it overnight into OpenAI's product suite would certainly accelerate its product roadmap: the AI leader has recently launched Codex, plus Agents SDK and the Responses API for custom agents.

Defend position AI coding market

OpenAI has been clearly losing the race of AI coding solutions. Microsoft had a head start with Github Copilot (also an acquisition), and so did Google with Colab (an online coding development studio) and Firebase (back-end service for data storage and authentication), which enabled it to launch Firebase Studio, an AI software prototyping application. Anthropic with Cloud Sonnet is already the backbone of Cursor (Windsurf’s no1 competitor). So, OpenAI clearly had to do something to avoid being left behind and there were probably not many real alternatives: it tried but failed to acquire Cursor and Devin was already too expensive to acquire (double the valuation of Windsurf in summer 2024).

Talent acquisition

It's not easy to hire top-notch talent, and Winsurf’s success demonstrates that there is a strong technical and product team. What matters really in M&A acquisitions paid in shares is not just the valuation of the target, but also the valuation of the acquirer. 3 billion dollars may sound like a lot, but what about the 300 billion dollars that OpenAI is valued at? Effectively this means that the company's shareholders get diluted by 1% with this acquisition, which is the equivalent of acquiring a C-level executive and giving them 1% of stock options; this is something common.

So, if you think of this deal as a 1% premium to pay to hire a set of about 200 great people, then it seems like a small premium to pay.

🥊 The revenge of the GPT wrappers

🎨 Painted with the same brush

Our view is that painting every AI application with the same “GPT Wrapper” brush is false. This is similar to software:

Software sits on top of an infrastructure layer (Cloud)

Despite being commoditised, the infrastructure layers generates hundreds of billions of revenues

There is simple software that is easy to copy and complex software that is defensible

This is also the case with AI applications that sit on top of AI infrastructure (models, datacenters, chips) and the vulnerability of simple versions(GPT Wrappers) that are easy to copy.

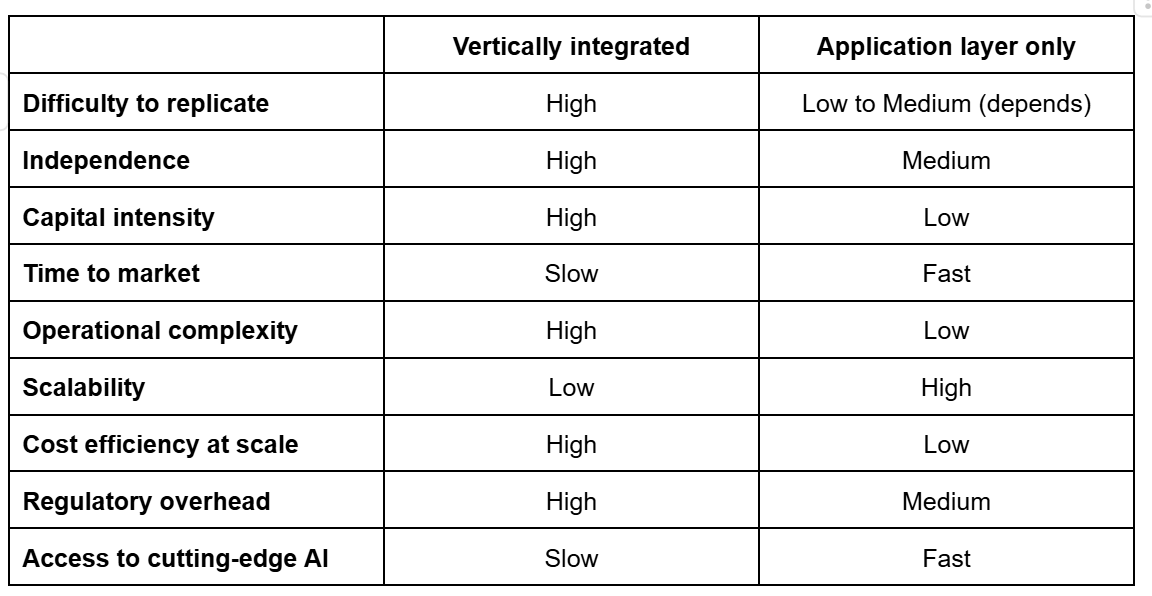

Beyond the need to discriminate between AI applications, a vertically-integrated solution may or may not be more appropriate than a pure-play application layer depending on the market and use case.

Vertically-integrated solutions are harder to replicate, more independent (as they may incorporate infrastructure instead of licensing it) and are quite cost-efficient at scale (due to the high level of fixed costs). On the other hand, application-layer-only solutions are capital-efficient, have a much faster time to market, operationally are simpler to execute, scalability is higher (can grow much faster) and have a lower regulatory overhead (regulations tends to focus so far on developers of AI models). It is also easier for them to access cutting-edge AI - when a research breakthrough happens, they simply switch from one 3rd party AI model to another (including open source).

📈 Drivers of value of AI applications

So, within the pure-play AI Application Layer market, solutions have a lot of drivers of value and we don't disregard them as investors, quite the opposite.

What are these value drivers?

Data network effects: Also known as Knowledge Graph, the usage data that helps make an AI product better.

Must have: Integrating deeply into the workflows of the users and becoming an indispensable part of someone's daily job.

User community: Touching hundreds of thousands of users every day with a large potential of monetising them even further by cross-selling solutions.

Becoming a distribution gatekeeper: Owning the end user and deciding what other third-party products they can consume or not. This could lead to making revenue-share agreements with new entrants.

Product leadership: Being a sustained thought leader and pioneer in product design and user experience. This can be seen in lower customer acquisition costs (through virality/ word of mouth), combined with high user engagement and user retention, which result in building a large business.

🔮 A glimpse into OpenAI’s strategy

Imagined design of the OpenAI/io device (source: Ben Geskin)

Based on io’s history and various comments made by Sam Altman, OpenAI’s CEO, it looks like OpenAI will work on a small screenless device that is not wearable and has a similar functionality to Bee - it’s aware of what you're doing throughout the day and helps you become more productive.

But why did OpenAI spend 6.5 billion dollars to acquire a pre-product hardware startup?

OpenAI aspires to become the next trillion-dollar company, and there's one thing that other trillion-dollar Tech companies have in common: vertical integration. It seems to be the main path, if not the only one, to get to such a high value:

Amazon: Has its own cloud infrastructure (the AWS business), marketplace and hardware devices (e.g. Alexa).

Google: Has its own AI chips (the TPUs), its own cloud infrastructure (GCP), its own phone tablets (the Chromebook), its own operating system (Android) and applications (Gmail, Google Docs, etc).

Microsoft: Has its own laptops and tablets (Surface), cloud infrastructure (Azure), its own operating system (Windows) and end-user applications (e.g. Office 365).

Apple: Has its own phones, tablets and laptops (iPhone, iPad, Mac, etc.), its own operating system (iOS) and end-user applications (e.g. Safari).

This is definitely the playbook that OpenAI is following, and in order to understand it and predict its evolution, we need to ask two key strategic questions:

What are the ingredients needed to deliver intelligence (output of its AI models)?

Where and how is intelligence consumed by end-users?

We've seen this vertical integration already playing out in OpenAI’s case. The company started by building its own AI models (GPT-1, GPT-2, GPT-3), then, below that layer it decided to buy and own Nvidia AI chips (after raising billions of dollars) and above the model layer it launched a consumer application, ChatGPT, and small-business solution, its API platform,

And there is more to come in the future. In terms of the infrastructure layer (below the model layer), it was first leaked that OpenAI is working on its own AI chip in collaboration with TSMC and the company recently announced it is building a huge datacentre in the UAE. In terms of where intelligence is consumed, Windsurf’s acquisition is an expansion within the application layer reaching directly millions of developers. And io’s acquisition is yet another initiative to directly reach end users, this time with an intelligent device.

See you next time for more AI insights.

Excellent work