The Artificial Investor - Issue 50: What AI tells us about the future of the US/China trade war

✍️ The prologue

My name is Aris Xenofontos and I am an investor at Seaya Ventures. This is the weekly version of the Artificial Investor that comments on one of the top AI developments of the last seven days.

This Week’s Story: Nvidia and Tesla announce damages from AI supply chain disruptions

Nvidia said it will take a 5.5 billion-dollar financial hit after Washington placed fresh restrictions on the export of its H20 AI chips to China, sending the stock about 7% down on the day. A few days later, Elon Musk warned that a rare earth magnet shortage, caused by China’s announcement of restrictions around the export of rare earth elements (REE) to the US, would delay the launch of Tesla’s humanoid robots. This came only a few days after it was reported that Apple chartered cargo flights to transfer 1.5 million iPhones from India to the US, after it stepped up production there in an effort to navigate US’s import tariffs on China. Stock markets have reacted negatively to the trade war news recently, with S&P 500 down 14% on the days after the US import tariff announcement (but recovering back to only 2.5% below decline the pre-tariff announcement levels within three weeks).

What are import tariffs and why were they introduced by the US administration? How is the US/China trade relationship affected? How is each country dependent on the other across the AI supply chain? Who is winning where and what should we expect for the future?

Let’s dive in.

Introduction

🧾 What is an import tariff and what are its effects typically?

An import tariff is a tax that a government places on goods coming into the country from abroad. When a product arrives at the border, customs officials calculate the tariff based on its value or quantity, the importer pays the tariff to the government and, when possible, the importer passes this extra cost along to customers by raising the price of the product.

The typical effects are:

Higher prices for consumers, as imported goods become more expensive

Protection for domestic industries, as local products become relatively cheaper than imported ones

Reduced imports, as higher costs usually mean some consumers cannot afford imported goods

Potential trade war, as other countries might impose their own tariffs to retaliate

Supply chain disruptions, as companies relying on imported parts face higher costs or sourcing challenges

Shifts in manufacturing, as tariffs can push companies to move production to other countries to avoid the taxes

🤝 A closer look at US/China’s trade relationship

Why is the US focusing so much on the trade relationship with China?

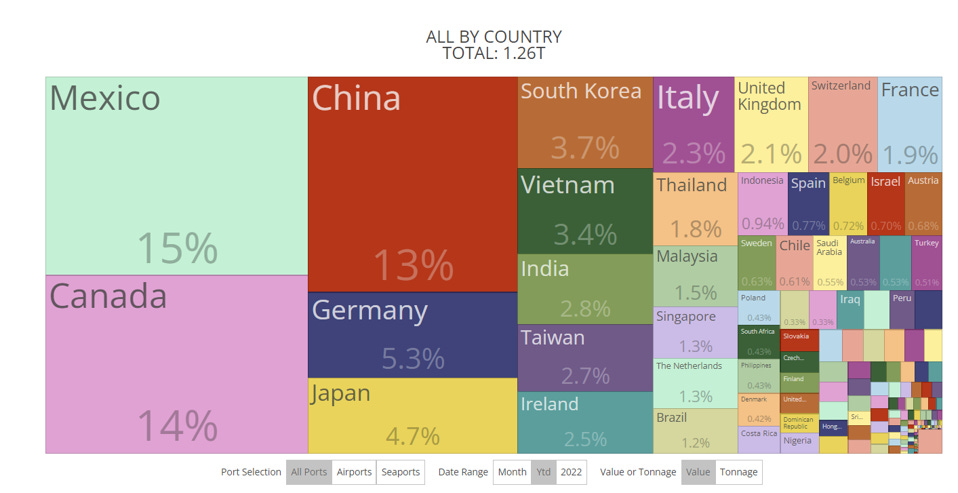

The reason becomes clear once you have a look at the main sources of US imports: China has a unique combination of being an adversary (not allied country) and large exporter to the US.

Source: Forbes

An important context of the trade relationship between any set of countries is the trade balance between them, i.e. understanding what is the result of the value of all imports minus the value of all exports of one country to the other country. In 2024, the US imported 440 billion dollars of goods from China while it exported only 144 billion dollars, which means that it recorded a goods trade deficit of approximately 300 billion dollars with the Asian country. This is mainly caused by the fact that China serves as a central hub in global manufacturing, often assembling products using components sourced worldwide. Other factors driving this trade deficit are the U.S. households’ low savings and high consumption rates, which contrast with Chinese households’ high savings rate, as well as the US dollar’s strength that makes U.S. exports relatively more expensive and imports cheaper.

What local industries is the US government trying to protect?

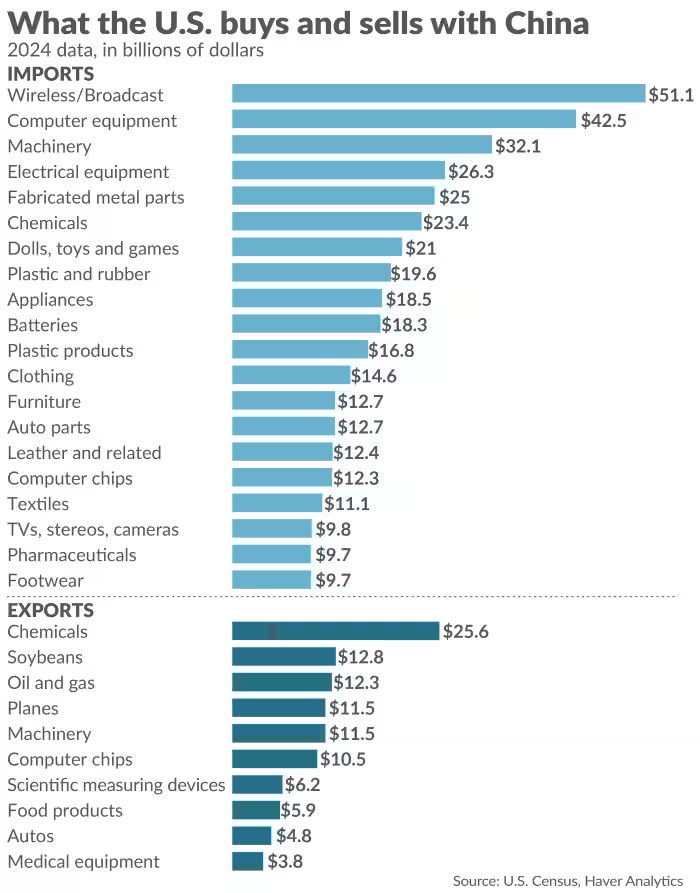

Let’s have a look at what products is the US importing from China.

It looks like the main industries affected are:

Computer, Electronics and Electrical Equipment with 30%

Machinery, Various Parts and Chemicals with 29%, and

Clothing and Textiles with 6% of total imports

Toys, Appliances and Batteries, are also affected, each accounting for 5% of imports.

This graph explains two things:

Why we saw negative supply-chain-related news coming out of Apple and Tesla (imports of electronics and equipment)

Why Nvidia has been in the eye of the storm: the 10 billion-dollar US export chips to China reflect largely Nvidia’s chip sales to the Red Dragon (actually, it is estimated that more Nvidia chips reach China via its sales to Singapore and Hong Kong).

⛓️ The AI supply chain and US/China dependencies

The AI supply chain consists of the following layers: 1) raw materials extraction and processing, 2) semiconductor chip design (R&D), 3) semiconductor fabrication (wafer fabs), 4) semiconductor manufacturing equipment and inputs, 5) chip packaging, assembly and testing, 6) printed circuit boards and electronic components and 7) hardware assembly and integration.

Let’s analyse every layer to understand the US/China interdependencies:

1. Raw materials extraction and processing

Explanation: Mining and refining a variety of minerals and metals, such as REEs (used in high-performance magnets and some components), silicon (for wafers), cobalt and lithium (for batteries and power systems), gallium and germanium (for semiconductor substrates and specialised chips).

Who is winning: China. Contrary to popular belief, mining actually takes place around the world, including the US and Australia. However, 90% of the global refining of all raw materials happens in China. China also mines 70% of REEs.

Key companies: The Chinese Northern Rare Earth Group, the American MP Materials and the Australian Lynas Rare Earths for REEs, the Chinese Tongwei and the Norwegian Elkem for silicon, the American Albermarle, Chilean SQM and Chinese Ganfeng for lithium, etc.

2. Semiconductor chip design (R&D)

Explanation: Designing AI chips, such as GPUs, TPUs, AI accelerators and CPUs for AI workloads

Who is winning: The US. Design know-how remains a US (and allied) strength, while China’s capabilities are improving from a low base. American companies have 60% market share, followed by Taiwanese (15%) and Chinese peers (10%).

Key companies: Nvidia (GPUs), AMD, Intel, Qualcomm (CPU) and Google (TPU) for chip design and Cadence, Synopsys for the development of electronic design automation (EDA) software in the US. HiSilicon (Huawei), Alibaba’s T-Head, Biren Technology and Cambricon for chip design in China.

3. Semiconductor fabrication (wafer fabs)

Explanation: The capital- and technology-intensive process of manufacturing chips in semiconductor foundries.

Who is winning: Tie. Taiwan is the leader with 70% broad market share and 90% in advanced chips. Taiwan is a US ally, but also vulnerable due to its proximity to and history with China. US and China market shares are minimal (5% - 6% each).

Key companies: TSMC in Taiwan (fabricates Nvidia’s chips), Samsung in South Korea, GlobalFoundries in the US, and SMIC and Hua Hong Semiconductor in China.

4. Semiconductor manufacturing equipment and inputs

Explanation: This captures the tools and materials needed to run fabs, such as lithography machines, etchers, deposition equipment, specialty chemicals, silicon wafers and photomasks.

Who is winning: The US. Netherlands and Japan (US allies) produce the critical lithography equipment and also supply key chemicals and wafers. The US leads manufacturing in other fab tools (deposition, etch, inspection). China controls much of the global supply of raw silicon and polysilicon (important for silicon wafers and solar cells) and some specialty chemicals.

Key companies: ASML in the Netherlands and Nikon and Canon in Japan for lithography machines, Applied Materials, Lam Research and KLA in the US for other fab tools, Tokyo Electron and Shin-Etsu Chemical in Japan for key chemicals and wafers, and AMEC, Naura and SMEE in China.

5. Chip packaging, assembly and testing

Explanation: After chips are fabricated on wafers, they must be cut, packaged into protective modules and tested. This stage, often called Assembly, Testing, and Packaging (ATP), is more labor-intensive and lower-margin than chip fabrication.

Who is winning: China. Taiwan leads the market with more than 50% share, followed by China with 20%. The US has only a minimal share (3%). All other players are in Asia.

Key companies: ASE and Siliconware Precision in Taiwan, JCET and Tianshui Huatian in China, Samsung in South Korea and Amkor in the US.

6. Printed circuit boards and electronic components

Explanation: No AI system can function with just chips alone – they need printed circuit boards (PCBs) to mount chips and connect them, as well as many other electronic components (capacitors, resistors, power supplies, etc.). PCBs are the foundation (the “skeletal” infrastructure) of all electronics.

Who is winning: China. China produces more than 50% of the world’s PCBs by volume, followed by Taiwan - the US produces only 5%. Other components, such as power management modules, connectors and cooling systems for servers are also often made in China or sourced from Chinese suppliers.

Key companies: DSBJ and Shennan Circuits for telecom in China, Zhen Ding and Unimicron for mobile and computing in Taiwan, and TTM Technologies for high-end boards in the US.

7. Hardware assembly and integration

Explanation: The final stage of building the actual AI hardware systems, like AI accelerator cards, servers and devices.

Who is winning: China. US companies, such as Apple, Dell, HPE and Supermicro design and sell many of these systems, but the physical assembly is frequently done by contract manufacturers in China or nearby. Server assembly for data centers is often performed in Taiwan and China. Consumer AI-driven devices, such as smartphones, are mostly assembled in China.

Key companies: Foxconn, Quanta, Pegatron and Inspur in China (the first three are Taiwanese companies but most of their factory capacity is in China).

In summary, the AI supply chain is currently geographically concentrated. The US contributes crucial design, R&D and some high-tech manufacturing (like fab equipment and some chips), whereas China (and East Asia broadly) contributes raw materials refining, the bulk of manufacturing capacity, and low-cost assembly. Taiwan and South Korea are indispensable for advanced semiconductors, while China is indispensable for materials and manufacturing scale. Our layer-by-layer US/China battle led to China’s victory with a score of 5-3. And it’s not as simple as that. The American dependence on China in key areas, such as smartphones, computers and batteries, is very high, given that 75%+ of supplies come from the Red Dragon.

📕 Conclusions

So, where does all this lead us?

🏋️ It’s all about leverage

To begin with, China has more leverage over its American peer. The US owns some parts of the chain that enable advanced components, and without them, the technology would be less advanced and go back 2-3 years. However, China owns some other parts of the chain that are vital and no chip, regardless of its quality and sophistication, could ever get produced. Thus, it came to no surprise to see China’s rapid retaliation on the Trump administration’s introduction of aggressive import tariffs. The conflicting US-China statements about whether the two countries are having active trade deal discussions probably reflect US’s desire to start negotiations and China’s confidence about its competitive position and future outcome of the trade discussions.

As the US continues with its nationalistic and trade war tactics, we expect further escalation to take place. For now, China has been relatively gentle by doing the obvious, and probably something that was overdue: introduce an Import Permit process for US companies that want to import REEs from China (Tesla is going through the permit process, hence its delays) and a black list of Defence-related US companies that cannot import anything Tech-related from its domestic manufacturers. China could introduce export tariffs for REEs or even ban their export to the US and its close allies.

📉 Who would lose from an escalated AI trade war?

Unfortunately, AI innovation will be impacted negatively both on the supply (hardware supply chain disruptions) and demand side (financial disruptions of corporates who buy AI technology; macro uncertainty reduces funding appetite for investors). Also, as seen in the latest headlines, US BigTech companies are likely to suffer, given the extent of their reliance on AI infrastructure and products for their revenue growth. Other losers include some booming US-and-ally-dominated sectors across the AI supply chain, such as the Semiconductor Chip Design and Semiconductor Manufacturing Equipment.

🔮 What to expect in the future

Our prediction is that a deal will be probably made before the end of the year (which is in line with one of our 2025 AI predictions). Some companies will announce investments in the US, a couple of domestic manufacturers will onshore, another couple will “friendshore” and some foreign producers will announce US factory construction projects. Trump will announce a new Independence Day and declare victory. Supply chain experts and stakeholders will be aware of the fact that there is more than meets the eye and acknowledge that not much will have truly changed. Taking into account the construction lifecycle of many stages of the AI supply chain, it will take 5-10 years before a meaningful change in the power dynamics of the AI supply chain.

Another conclusion from our AI supply chain analysis is the strategic importance (and potential single point of failure) of Taiwan. What will happen with Taiwan? How likely is a military conflict there, which involves China and the US? This is something that it’s difficult to predict, but we certainly would not exclude it.\

See you next week for more AI insights!